In the late 1990s, Enron Corporation was celebrated as a paragon of innovation and success in the energy sector. Headquartered in Houston, Texas, Enron was lauded for its pioneering approach to energy trading and its rapid ascent in the business world. However, beneath this veneer of prosperity lay a web of deceit and fraudulent practices that would eventually lead to one of the most infamous corporate scandals in history.

The Rise of Enron

Founded in 1985 through the merger of Houston Natural Gas and InterNorth, Enron initially operated as a traditional energy company. Under the leadership of CEO Kenneth Lay, the company shifted its focus towards energy trading, transforming into a commodities trading giant. By the late 1990s, Enron had diversified into various markets, including electricity, natural gas, and even broadband services.

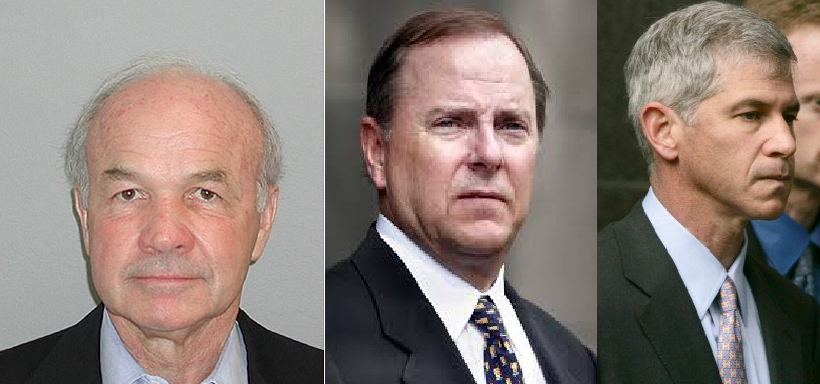

Key Figures Behind the Scandal

- Kenneth Lay: As the founder and CEO, Lay was instrumental in Enron’s strategic direction. He promoted aggressive expansion and endorsed the use of complex financial structures.

- Jeffrey Skilling: Serving as COO and later CEO, Skilling was a proponent of innovative trading strategies and played a pivotal role in implementing the company’s risk management practices.

- Andrew Fastow: As CFO, Fastow engineered intricate financial arrangements that concealed the company’s mounting debts and inflated its earnings.

The Deceptive Practices Unveiled

Enron’s downfall was precipitated by a series of deceptive accounting practices designed to present a facade of financial health. Central to this deception was the use of Special Purpose Entities (SPEs).

Special Purpose Entities (SPEs)

SPEs are separate legal entities created for specific transactions or projects. Enron utilized these entities to offload debt and toxic assets from its balance sheet, thereby hiding its financial liabilities from investors and regulators. This manipulation allowed Enron to appear more financially robust than it truly was.

Mark-to-Market Accounting

Another critical factor in the scandal was Enron’s adoption of mark-to-market accounting. This method involves valuing assets based on their current market value rather than their historical cost. While legitimate in certain contexts, Enron exploited this approach to record projected future profits as current income. This practice led to significant discrepancies between reported earnings and actual cash flow.

The Unraveling of the Scandal

In 2001, signs of trouble began to surface. Analysts and investors started questioning Enron’s opaque financial statements and the complexity of its business model. In August of that year, Jeffrey Skilling resigned as CEO, citing personal reasons, which further fueled suspicions.

By October 2001, Enron announced a significant reduction in shareholder equity due to losses in its SPEs. This revelation led to a sharp decline in stock value and increased scrutiny from regulatory bodies. The Securities and Exchange Commission (SEC) launched an investigation into the company’s accounting practices.

The Fallout

On December 2, 2001, Enron filed for bankruptcy, marking one of the largest corporate bankruptcies in U.S. history at that time. The collapse had far-reaching consequences:

- Employee Impact: Thousands of employees lost their jobs and saw their retirement savings, heavily invested in Enron stock, evaporate.

- Investor Losses: Shareholders lost billions as the company’s stock became worthless.

- Auditor Consequences: Arthur Andersen, Enron’s auditing firm, was implicated in the scandal for its role in approving the company’s misleading financial statements. The firm faced criminal charges, leading to its eventual dissolution.

Legal Repercussions

The scandal led to numerous legal proceedings:

- Kenneth Lay: Indicted on multiple counts, Lay was convicted but passed away before sentencing, leading to the vacating of his convictions.

- Jeffrey Skilling: Convicted on multiple charges, Skilling was sentenced to prison but was released in 2019 after serving 12 years.

- Andrew Fastow: Pleading guilty to fraud charges, Fastow cooperated with prosecutors and served a reduced sentence.

Regulatory Changes Post-Enron

The Enron scandal prompted significant changes in corporate governance and accounting practices:

- Sarbanes-Oxley Act of 2002: This legislation introduced stringent reforms to enhance corporate transparency and accountability. Key provisions included:

- Establishment of the Public Company Accounting Oversight Board (PCAOB): To oversee the audits of public companies.

- Enhanced Financial Disclosures: Requiring top executives to certify the accuracy of financial statements.

- Stricter Penalties: Imposing harsher penalties for corporate fraud.

Lessons Learned

The Enron debacle serves as a cautionary tale about the dangers of unchecked corporate greed and the importance of ethical governance. Key takeaways include:

- Transparency: The necessity for clear and honest financial reporting.

- Accountability: Holding corporate leaders responsible for their actions.

- Regulatory Oversight: The critical role of regulators in monitoring corporate behavior to prevent similar scandals.

In retrospect, the Enron scandal underscores the imperative for integrity in business practices and the continuous need for vigilance to uphold the principles of ethical corporate conduct. Thank you for your valuable to read this article.