In December 2008, the financial world was rocked by the shocking revelation that Bernie Madoff, a highly respected Wall Street financier, had orchestrated the largest Ponzi scheme in history. The scale of the fraud was mind-boggling: approximately $65 billion in fake account statements and $19 billion in actual lost funds. Thousands of investors—ranging from wealthy individuals to charities and pension funds—lost everything they had entrusted to Madoff’s firm, Bernard L. Madoff Investment Securities LLC.

But how did this massive deception go unnoticed for decades? Why did people trust Madoff so blindly? And what led to his downfall? Let’s dive deep into this infamous financial scandal.

Who Was Bernie Madoff?

Before he became synonymous with fraud, Bernard Lawrence Madoff was a well-respected figure in the investment world. Born in Queens, New York, in 1938, Madoff started his finance career in 1960 with a modest investment of $5,000. Over the years, he built Bernard L. Madoff Investment Securities LLC, which became one of Wall Street’s most trusted firms.

Madoff was also a pioneer in electronic trading and served as chairman of NASDAQ in the early 1990s. His reputation, connections, and apparent success made him a magnet for wealthy investors.

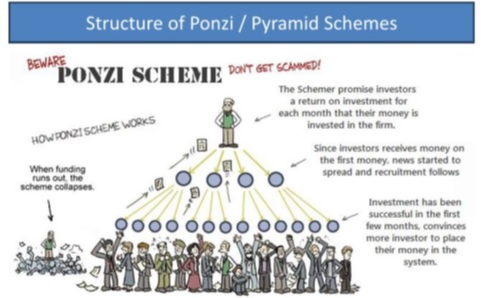

What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment operation where returns are paid to earlier investors using money from newer investors rather than actual profits from investments. The scheme depends on a constant flow of new money—once that stops, the fraud collapses.

Madoff’s scheme was unique in its longevity and scale. Unlike typical Ponzi schemes, which collapse within a few years, Madoff’s fraud lasted for decades because of his carefully crafted illusion of legitimacy.

How Did Madoff Pull It Off?

1. The Secretive & Exclusive Image

Madoff created an aura of exclusivity. His clients were often referred by word-of-mouth, and he selectively chose who could invest with him. This made people feel privileged to be part of something “special.”

2. Consistent Returns (Too Good to Be True)

Investors were promised steady returns of 10-12% annually, regardless of market conditions. In reality, such consistent gains are nearly impossible.

3. Fake Account Statements

Madoff’s firm produced phony financial statements, showing investors that their money was growing when, in fact, it wasn’t invested at all.

4. No Independent Oversight

Although Madoff’s firm was registered with the Securities and Exchange Commission (SEC), it avoided rigorous audits. He used his reputation and personal connections to deflect scrutiny.

Who Were the Victims?

Madoff’s scheme affected thousands of investors, including:

- Wealthy individuals: Celebrities like Steven Spielberg and Kevin Bacon were among the victims.

- Charities: The Elie Wiesel Foundation for Humanity lost its entire investment.

- Banks and Hedge Funds: HSBC, Banco Santander, and Fairfield Greenwich Group had massive exposure.

- Everyday retirees: Many middle-class investors who entrusted their life savings to Madoff were wiped out.

The Collapse: How Madoff Was Caught

1. The 2008 Financial Crisis

The economic downturn in 2008 led many investors to withdraw their funds. This was a problem for Madoff because his firm wasn’t actually investing money—it was just moving funds around. He needed new investors to pay off the old ones.

2. The $7 Billion Withdrawal Request

In December 2008, investors asked for $7 billion in redemptions. Madoff couldn’t produce the money.

3. The Confession

On December 10, 2008, Madoff confessed to his sons, Mark and Andrew, that his entire operation was a fraud. Shocked, they reported him to the FBI.

4. The Arrest

The next day, on December 11, 2008, Madoff was arrested at his Manhattan apartment.

The Fallout

Legal Consequences

- On March 12, 2009, Madoff pleaded guilty to 11 federal felonies.

- On June 29, 2009, he was sentenced to 150 years in prison.

Impact on Victims

- Many lost their entire life savings.

- Charities were forced to shut down.

- Some victims, overwhelmed by financial ruin, took their own lives.

Madoff’s Death

Bernie Madoff died in April 2021 at the age of 82 while serving his sentence.

Questions & Answers

Q: Why did people trust Madoff? A: His reputation, exclusive clientele, and steady returns made him seem like a financial genius.

Q: Did the government fail to catch him earlier? A: Yes. The SEC received multiple warnings over the years but failed to investigate thoroughly.

Q: Did Madoff’s family know? A: Madoff insisted that his wife and sons had no involvement. His sons turned him in.

Lessons from the Madoff Scandal

- If it sounds too good to be true, it probably is.

- Always verify where your money is being invested.

- Regulatory oversight must be stronger and more vigilant.

The Madoff scandal serves as a stark reminder of the devastating consequences of unchecked financial fraud. By learning from history, we can prevent future Ponzi schemes from ruining lives.